Who Will Build the Next Big Tech Hub?

takiwa/Shutterstock.com

A new report digs into the metrics of America’s emerging tech hubs, and finds some surprises.

High-tech talent is a key driver of the wealth and competitiveness of cities. But it’s highly concentrated in places across the United States and the world, following a winner-take-all pattern and reinforcing the geographic inequality that underpins our broader economic and political divides.

While all of America’s top-ranked tech cities have a highly-skilled and highly-educated workforce, a whole host of other factors could shape which city is best positioned to be the next Silicon Valley. That’s a key takeaway from a new index created by real estate firm Cushman & Wakefield that identifies America’s 25 leading high-tech metro areas in 2016. The report covers some familiar ground—but it also contains some surprises.

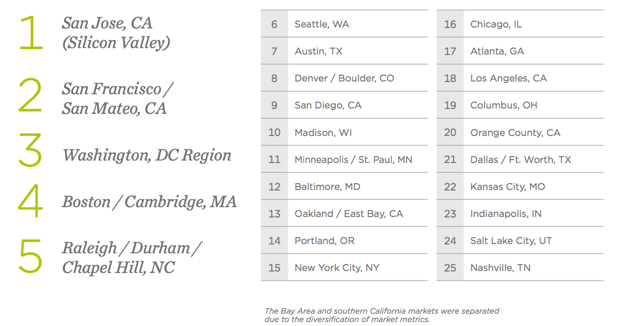

The top of the list is a no-brainer: The San Jose metro, the heart of Silicon Valley, comes in first, followed by San Francisco. Less expectedly: Established tech centers like New York (where Mayor Bill De Blasio is promoting an ambitious tech-jobs program), Los Angeles, even Austin and Seattle land far down the list. Baltimore bests New York City. Portland tops Los Angeles. And Washington D.C. ranks third, ahead of Boston-Cambridge. The top 25 includes budding tech hubs large and small, such as Madison, Indianapolis, Columbus, Kansas City, Minneapolis, Philadelphia and more. Some aspiring tech hot spots—Pittsburgh, Detroit, Miami, Provo, and Ann Arbor—are noticeably absent.

What’s going on here? There is no right or wrong answer, and the study and listing are based on a very thorough dive into the data and indicators. But the results boil down to what factors are included in the analysis. The report is heavily weighted toward talent, something I surely consider valuable (it is one of my 3Ts of economic development)—but this weighting may do more to reveal the most highly educated and knowledge-based metro areas, rather than which ones are actual commercial centers of high-tech industry.

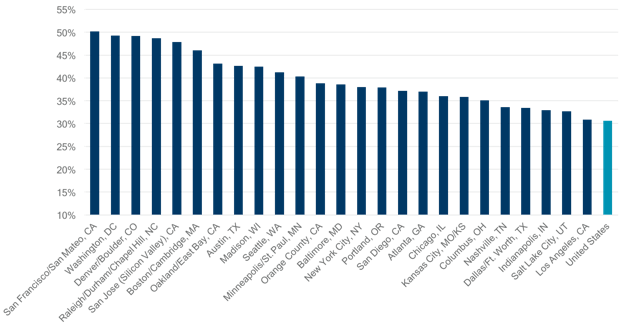

The first of these talent indicators is the share of adults with a bachelor’s degree. It’s a solid indicator of educational attainment or human capital, but does it really capture leading tech hubs?

San Francisco* tops the list, followed by D.C., Denver/Boulder, Raleigh-Durham, San Jose, Boston, Oakland, Austin, Madison, and Seattle. Much larger metros which a more diverse cross-section of people, like New York and Los Angeles, rank much further down the list.

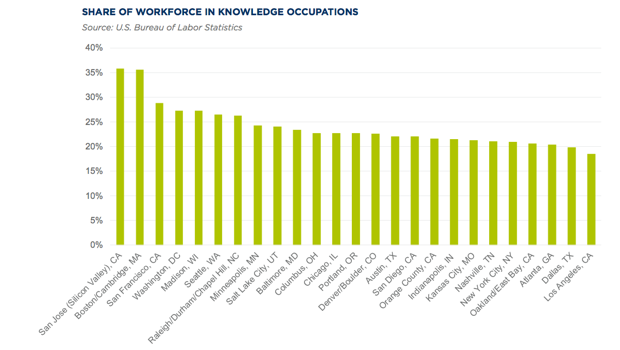

Second is the share of knowledge workers. I like this measure too, as it includes workers in management; computer and math; architecture and engineering; life, physical, and social sciences; health; and education. It is essentially my creative class, minus the artists, musicians, and designers. The same places top the list, but in somewhat different order. San Jose is first, followed by Boston, San Francisco, D.C., Madison, Seattle, and Raleigh-Durham. Here again, the ranking skews to knowledge hubs and college towns and away from larger, more socio-economically diverse places.

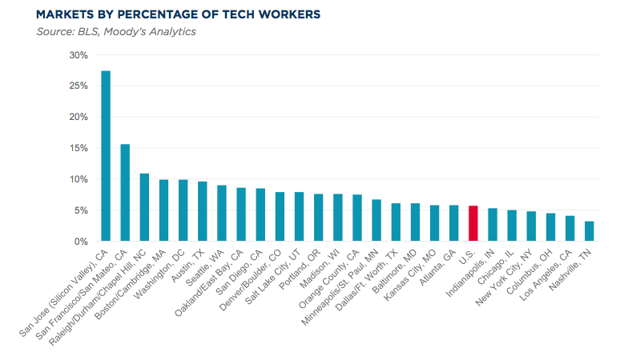

The third talent metric is the share of tech workers. This seems more to the point for a ranking of tech hubs. Still, it’s basically a subset of knowledge workers listed above, focusing on workers in computing, software, telecom, data processing, pharmacy, and medical devices among other tech fields. A similar list once again: Silicon Valley is again on top, followed by San Francisco, Raleigh-Durham, Boston, D.C., Austin, and Seattle. And again, New York City and Los Angeles land much further down the list.

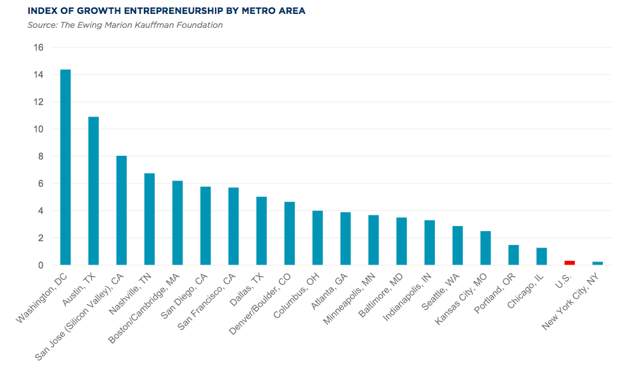

The study also includes a measure of growth entrepreneurship, based on research by the Kauffman Foundation that includes metrics for the startup growth rate, the scale of startups, and high-growth company density. Now Washington, D.C., tops the list, followed by Austin, Silicon Valley, Nashville, Boston, San Diego, and San Francisco. New York is far down the list.

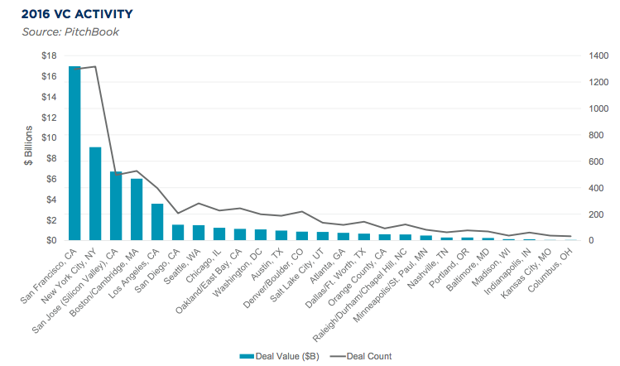

The final indicator, to my mind, is the single best one for distinguishing real centers of high-tech industry: venture capital investment in high-tech startups. This is a direct monetary gauge of high-tech hubs: It reflects the places actual venture capitalists are betting on high-tech businesses.

The data in this chart (and what follows) comes from Pitchbook data compiled for the National Venture Capital Association, the leading organization for venture capital funds and leading source for tracking the industry.

San Francisco proper tops the list with a whopping $16.9 billion in venture capital investment, almost double the second leading metro. But this chart understates the real extent of Greater San Francisco’s dominance in high-tech startups. Combined, San Francisco and San Mateo have nearly 40 percent of the national total, with $28.5 billion in venture-capital backed startups in 2016.

New York City rises to second on this metric with $9.1 billion in venture capital investment, putting it far ahead of San Jose (Silicon Valley) with $6.7 billion, Boston is fourth with $6 billion, followed by Los Angeles with $3.5 billion.

Six other metros attracted more than a billion dollars in venture capital investment in 2016, including San Diego and Seattle with roughly $1.5 billion each; Chicago with $1.25 billion; and Greater Washington, D.C., with $1.1 billion. Austin is close with just under $977 million in venture capital investment. Greater Miami is absent from the chart above, but attracted more than $1.2 billion in venture capital investment in 2016. It’s also worth noting that together Salt Lake City and Provo, about an hour’s drive from one another, also attracted more than a billion dollars in venture capital investment in 2016.

Digging deeper into that data shows us the dynamics of that chart’s long tail of smaller startup environments:

- Phoenix ($269 million), which is not on the chart above, attracted more venture capital investment than Baltimore ($254 million).

- Houston ($245 million), St. Louis ($244 million), and Pittsburgh ($228 million), none of which are on the chart above, fit above Raleigh-Durham ($218 million)

- New Haven ($200 million) had more than Madison ($143 million)

- A whole slew of metros—including Detroit ($128 million), Las Vegas ($122 million), Cleveland ($97 million), San Antonio ($78 million), Orlando ($69 million), Louisville ($68 million), and Ann Arbor ($62 million) had more than Columbus, Ohio ($62 million).

Education levels, knowledge workers, and the like tell us a lot about how smart metros are. But for my money, it’s real dollar investment in venture capital-backed startups that show us where America’s true high-tech spots are.

NEXT STORY: A Silicon Valley Congressman Takes On Amazon